Content

The general ledger provides a trial balance and is used to prepare financial statements such as the monthly income statement, balance sheet, cash flow statement, and profit and loss statement. Each of these subledgers includes information about the company’s assets and liabilities. General ledgers use the double-entry bookkeeping system, so every debit must have a corresponding credit and vice versa. This helps accountants determine whether a general ledger is balanced. If the sum of all listed assets, liabilities, and equity is zero, the ledger is balanced.

- In addition, they can also contain inventory balances, purchases and sales.

- If you wanted to see how much a customer spent on a particular day, you would have to visit the accounts receivable subsidiary ledger, which would have more information.

- While Purchase Journal records credit transactions, a General Journal records cash purchases.

- Double entry system of bookkeeping says that every transaction affects two accounts.

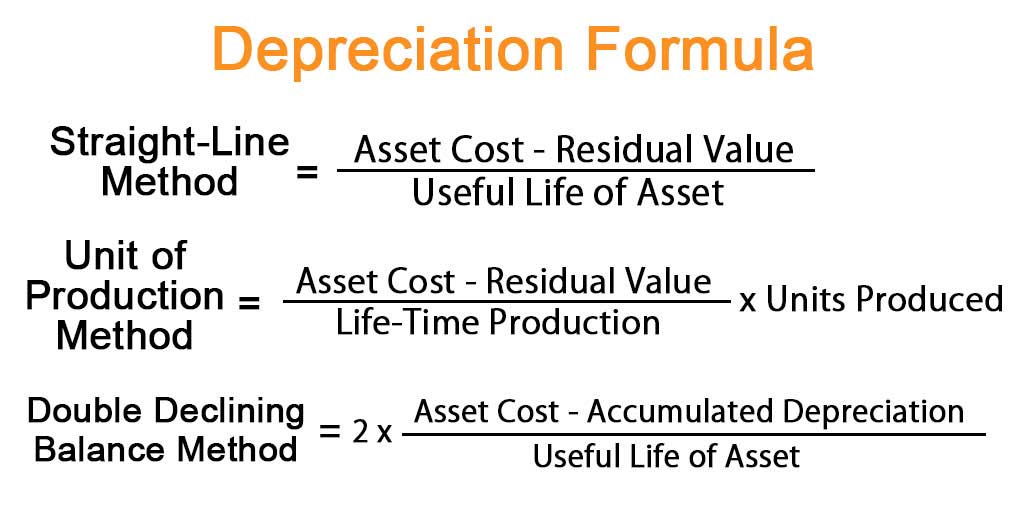

Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. General Ledger accounts should be balanced, but to the contrary, the general journal is not required to be balanced. The general ledger should include the date, description and balance or total amount for each account. For example, if you have an account with a local contractor but do not currently owe them for services, that account will carry a zero balance. Daniel Lewis is an MBA accredited investment professional who wants to assist small business owners to gain access to finance. After this, you will want to look into creating a trial balance to ensure that everything balances.

Similarities Between Journal and Ledger

The GL must be governed, clear, and able to comprise and account for all actions with a monetary impact in the institution while delivering consistent submission with Generally Acceptable Accounting Principles. Expenses consist of cash reimbursed by the company in exchange for a commodity or service. It enables you to more effortlessly place fraud or any other problem with your books since it is simple to look through and comprehend. By submitting this form, I consent to HighRadius sending me marketing communications and processing my personal information in accordance with the privacy policy. Bob borrows $25,000 from the bank to pay for renovation and improvement expenses on the property.

- On another hand, in the general ledger, there is no specific requirement for writing any narration.

- To retain the accounting equation’s net-zero discrepancy, one asset account must enhance while another reduces by the same quantity.

- The expenditure side of the income statement might be established on GL accounts for advertising expenses and interest expenses.

- The reference column will include a reference number that will be an easy indicator for which general ledger has the transaction been posted to.

Companies that follow a double-entry accounting process must post every transaction twice—once as a debit and one as a credit. The amount of the debit and credit must match to keep the accounts balanced. General ledger accounts are designed to handle a high volume of transactions, resulting in a high proportion of accountants’ time going into reviewing and matching these accounts monthly.

Definition of General Ledger

Auditors use it for this objective, to trace balances back to their private transactions. For instance, a CPA might use a T-account called because of its physical configuration in the shape of a T to trace just the credits and debits in a specific general ledger account. A General Ledger in accounting is a document of all preceding transactions of a firm, governed by the accounts department.General Ledger accounts comprise all credit and debit transactions influencing them. In expansion, they comprise detailed data about each transaction, such as the description, date, and amount, and may also encompass some illustrative information on what the agreement was. Both serve a distinct purpose and both are necessary for most businesses.

Are the general ledger and general journal the same?

The general ledger consists of the summary of every transaction that took place in the accounts, whereas the general journal contains the original set of entries for low-volume transactions.

Not only will you better be able to manage your business, but it could help you attract new investors and qualify for business loans as well. At the same time, your subsidiary ledgers allow you to go into far more depth when analyzing your business operations. For this reason, they are especially helpful for potential investors and lenders. The general ledger consists of the summary of every transaction that took place in the accounts, whereas the general journal contains the original set of entries for low-volume transactions. A company needs to review its general ledger regularly to keep track of all the accounts that they currently handle.

What is the general journal?

The general ledger can be used to help find useful financial information. The ledger can also support other accounting methods like cash What is the difference between a general ledger and a general journal? statements and trial balance. In accounting and bookkeeping, you must use both and cannot get away with using one or the other.

A ledger includes all the details such as revenues and expenses, liabilities, accounts for assets and the owners’ equity. In simple https://online-accounting.net/ words, inside a ledger, you will find all the information required to generate the financial statements of a business.